The lithium-ion battery market is rapidly growing primarily because of the electrification of the transport sector. However, the talent required to create a sustainable and affordable value chain in this nascent market is incredibly scarce. The skillset needed is highly specialized, and talent competition is fierce.

A complex industry

According to a study released by McKinsey in early 2023, almost 60% of today’s lithium is mined for battery-related applications, a figure that could reach 95% by 2030. Lithium reserves are well distributed and in theory sufficient to match battery demand. However, high-grade deposits are mainly limited to Argentina, Australia, Chile, and China. But increased demand for lithium-heavy batteries will require significant additional investment in mining projects, as well as increased sophistication in portfolio management and trading activity.

This has created a demand for skilled commercial professionals who can manage the procurement of lithium and other raw materials and negotiate contracts with suppliers. They also need to manage operations across the supply chain and navigate the various regulatory and environmental issues associated with the industry.

Thanks to its vantage position and business model in the commodities sector, HC Group has been able to create bespoke pools of candidates, as well as adequate talent strategies to meet the needs of diverse participants across the metals value chain.

The HC Insider Podcast

In a recent HC Insider podcast, Isobel Sheldon OBE, a leading authority in batteries and EVs and John Passalacqua, CEO of First Phospate Corp, explored the evolving applications of lithium-ion batteries, from electric vehicles, energy storage systems, and consumer electronics.

Trading Companies

For companies looking to enter this market or deepen their footprint in it, the high level of competition for talent is increasingly perceived as a barrier to entry.

Established trading talent with experience in lithium is scarce, if not non-existent. But some trading houses with a strong focus on metals are finding new ways to navigate this challenging market by taking advantage of their expertise and position in commodity trading. IXM, Traxys, Glencore have expanded their lithium activities. Others like Hartree and Open Mineral managed to hire top-rate traders to either build out or expand their trading desk. Meanwhile, trading companies interested in entering this segment are choosing to hire and train traders from adjacent markets, such as other battery materials, most notably nickel or cobalt, which would have a similar customer base as for lithium.

Trading houses are in a better position to leverage their existing relationships with suppliers and customers to negotiate favorable contracts and secure supply agreements for lithium. This is allowing them to provide a reliable supply of lithium to end-users and generate revenue from the price volatility of the commodity. Because lithium is a relatively new market with a high degree of uncertainty and risk, trading houses have a unique opportunity to differentiate themselves by providing market intelligence and risk management solutions to their clients.

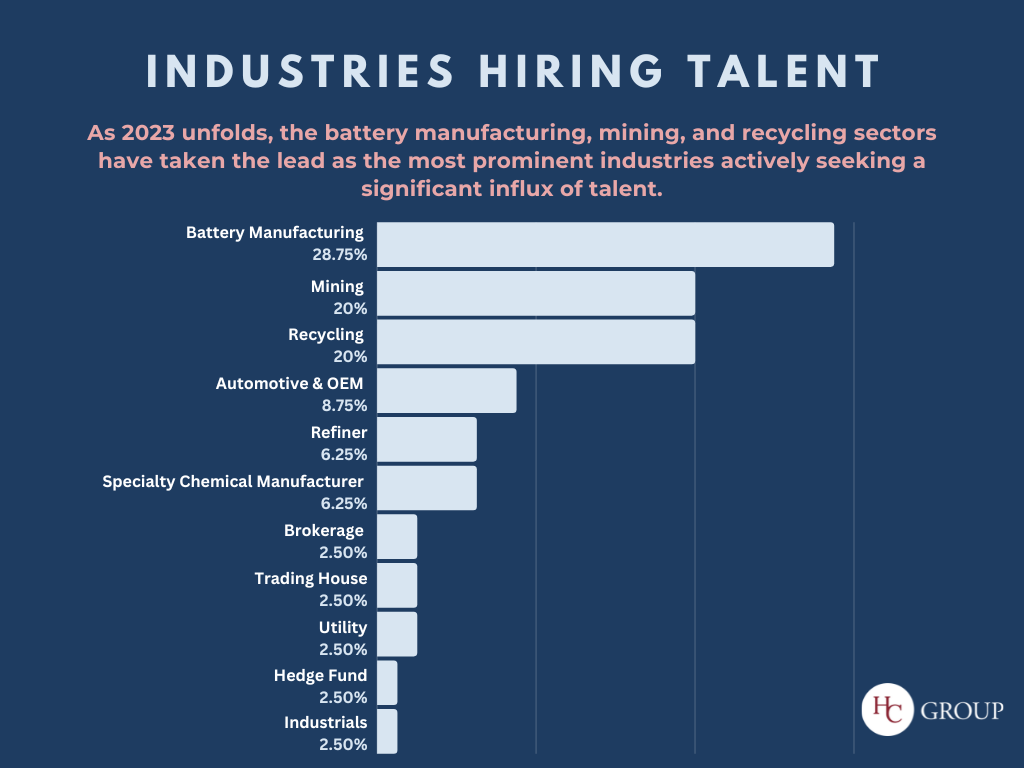

Diverse Industries

Other companies have adopted a strategy of tapping into different parts of the supply chain when searching for talent. Some trading companies have expressed interest in hiring individuals from the mining industry, or even from the battery manufacturing industry, who would bring key skills and expertise in battery materials sourcing and trading.

However, this pool of talent often lacks pure trading experience and does not always have the same corporate mindset or trading culture, which is placing greater emphasis on training and adequate development plans.

Additionally, other companies at both ends of these supply chains - from mining all the way to OEMs (Original Equipment Manufacturer) - are continuing to expand their teams, which is further increasing the demand for talent.

For any query related to HC Group’s activities in the battery metals segment please contact:

Premesha McDonald, Portfolio Director for HC Group’s Metals and Mining practice in Singapore.

Rina Kaciu, Senior Associate for HC Group’s Metals and Mining practice in London.

Automotive, OEM companies and Battery Manufacturing companies

Automotive and OEM companies are increasingly investing in the lithium supply chain due to their growing reliance on lithium-ion batteries for electric vehicles (EVs) and other applications.

These companies are keen to secure their supply of lithium and other key materials and reduce their dependence on third-party suppliers. Some automotive and OEM companies are investing in lithium mining and processing projects, forming joint ventures with lithium producers, and entering long-term supply agreements. By doing so, they can gain greater control over their supply chains, ensure the quality and sustainability of their raw materials, and reduce their exposure to price volatility.

For instance, Honda partnered with LG (alongside their existing partnerships with General Motors, and Stellantis), Toyota Motors with Panasonic, and BMW is developing its own battery recycling capabilities. Tesla is now reported to be setting up a Lithium Iron Phosphate (LFP) battery manufacturing plant in the US, in partnership with Chinese battery giant CATL.

As a result, automotive and OEM companies are also hiring talent from other companies active in different parts of the lithium supply chain. They are generally seeking professionals with expertise in lithium mining and processing, as well as in areas such as procurement, logistics, and sustainability.

Tesla and Apple have made a string of hires in recent years, tapping into the mining and trading talent pools, therefore creating more competition, notably with upstream players to attract individuals who can source material.

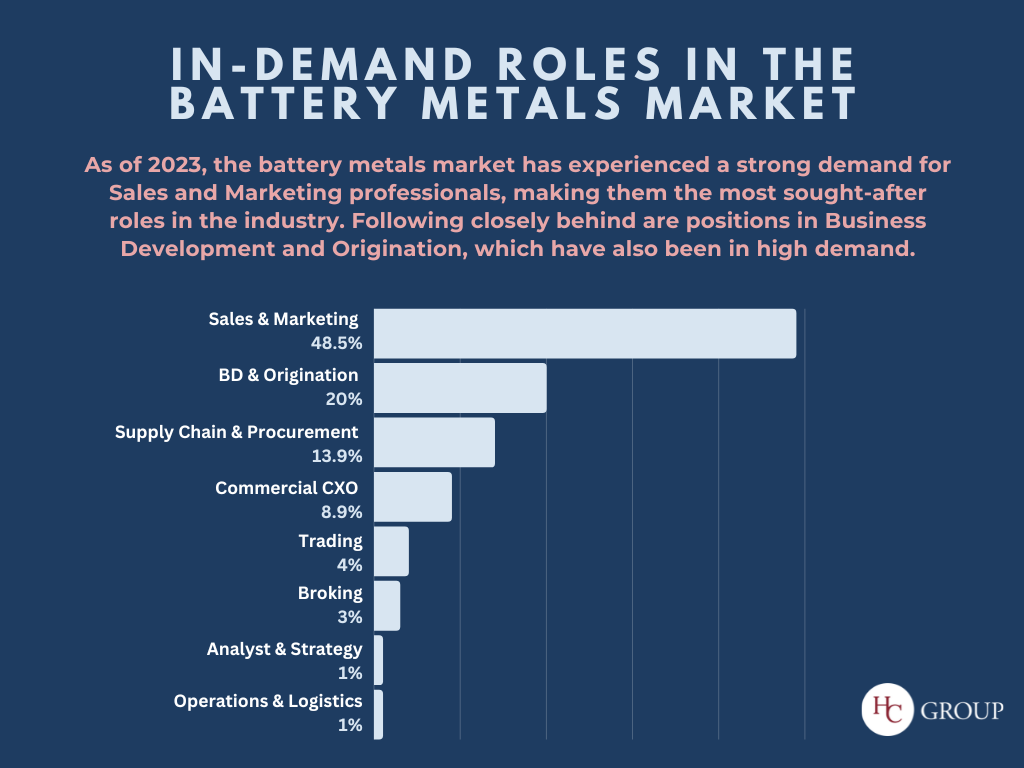

Skillsets in demand

HC Group has witnessed this rise in specialized talent demand through the 84 moves it has recorded over the 2022-23 period, from miners, traders, specialized chemical business experts, refiners, battery manufacturers and recyclers, to C-suite, business development, commercial, sales and marketing, supply chain and procurement professionals.

The variety of companies entering the lithium market means the skillsets that are currently in demand are equally diverse. For instance, battery recycling companies are in dire need of individuals who can support in building a supply chain and develop procurement capabilities. Similarly, many new entrants are faced with a lack of B2B marketing talent.

HC Group has been accompanying various participants with different backgrounds and positions in the nascent lithium value chain, gaining invaluable insights into this segment and the talent pool at its disposal. Against fierce talent competition, the support companies need extend beyond simple recruitment purposes. More than ever, the growth of the market means participants will increasingly need to attract and retain talent, especially by deploying adequate retention and talent development strategy. – Fatima Sadouki