2024 has already seen significant change in the talent required by commodities organizations. HC Group's Managing Partner and host of the HC Insider Podcast, Paul Chapman, reflects on a period of changing talent demand.

The nadir of the commodity trading sector, in recent professional memory, was some time in the mid 2010s. A quick review of the talent landscape at that point provides the all-important context to today.

The number of market participants globally had shrunk dramatically from just a few years before. A large proportion of banks had downsized, shed or sold their commodity desks driven by the fallout from the Global Financial Crisis. Merchant utilities had similarly shrunk or merged. Hedge funds had all but exited. Majors and refiners, with a few notable exceptions, had similarly scaled back trading ambitions. Independents, often private, and trading houses were really the only game in town with the appetite and means to grow – across all commodities – benefiting from a talent long market. Even then, oil trading was the major driver of performance.

This shrinkage in participants was compounded by the shrinkage in the number of seats within them. Some roles were regulated out of existence. Others were replaced by technology or outsourced as lower performance drove cost cutting. Consequentially, many of these “lost” roles were in the junior rungs in operations, risk, finance and analytics – the nursery ponds of future leaders. So not only did we lose a generation, we also lost qualified talent for other sectors or retiring early.

Read HC Group's Q1 Market Review for more key trends in executive search across energy and commodities value chains.

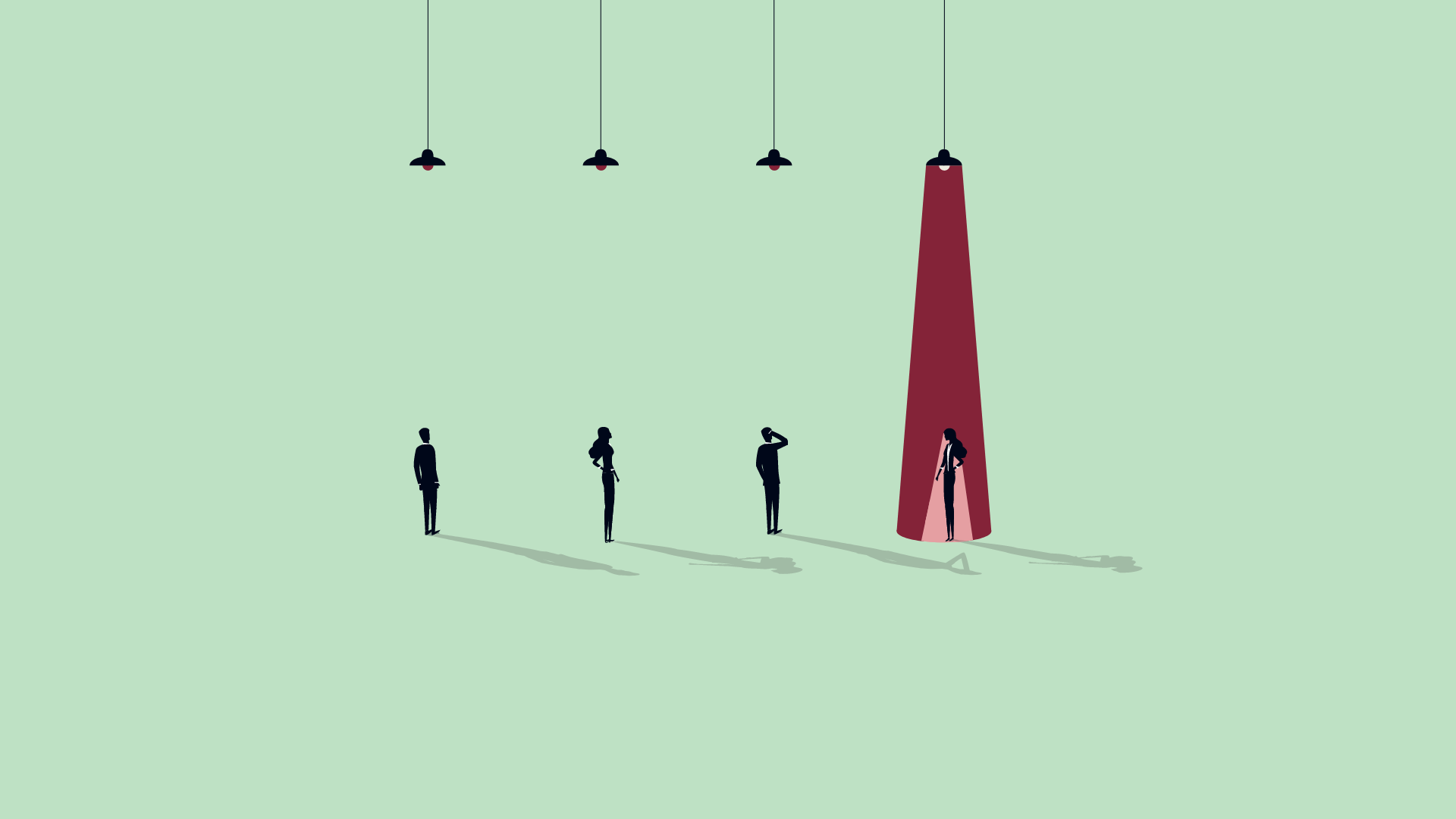

We are in a new paradigm where for the most part talent is both in demand and thin on the ground.

New opportunities

Which brings us to today. A world in energy transition, deglobalization and digitization has recreated a new suite of opportunities and volatility. This has re-opened the need for risk management and drawn in a welter of old and new participants. Globally, majors, NOCs, producers, refiners, growers and miners are building or expanding trading and marketing teams. Banks are toeing back in and CTAs, hedge funds and investors have been piling back in. At HC Group we see this in our data.

These changes are driving demand for new skillsets, often competed for by other sectors. Consider data scientists and battery technologists. Trading divisions also no longer have the luxury of being siloed in a single commodity vertical. For example, an oil trading group needs sight on other fuels such as LNG and power, ags for biofuels, and even metals for longer range energy transition impacts.

Thus in the long view, we are in a new paradigm where for the most part talent is both in demand and thin on the ground. Purpose and mission are crucial to attracting a new generation (p.s. if you want to solve the climate challenge then this sector is the place to be) and retaining the existing generation (one that is older, wiser and more focused on the long term). However, the trading floors of the future will look very different from those of a decade ago and it is that fact which the leading thinkers are working towards.

Managing Partner, HC Group

Host, HC Insider Podcast

Get briefed on key Q1 talent trends in commodities and energy globally.