U.S. midstream companies are navigating a complex landscape, marked by rapid export growth, tightening capital discipline from sponsors, and increasing regulatory scrutiny around carbon.

In our latest talent whitepaper, HC Group Portfolio Director Alex Coghlan examines the talent impacts from these market conditions, including how strategy is no longer separate from operations and how leadership is being reshaped from the C-suite down.

You can access the full whitepaper by filling in the form below.

This article provides a preview of HC Group’s Midstream Talent Trends Whitepaper. Complete the form below to gain full access to the report, which includes:

- In-depth analysis of leadership requirements

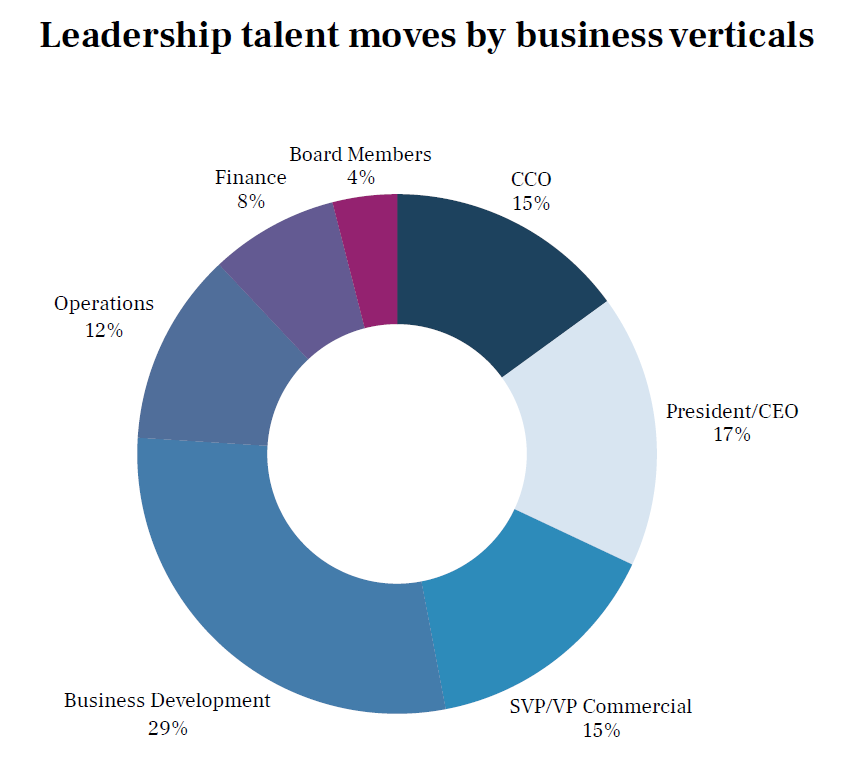

- Exclusive talent charts and data analysis

- Latest midstream talent moves

Access Our Talent Whitepaper

Fill in your details to download the full whitepaper

Leadership Challenge: a Complex Commercial Landscape

U.S. midstream leaders are navigating a challenging business landscape of rapid export growth, tightening capital discipline, and rising regulatory scrutiny around carbon. As arbitrage windows narrow and investor expectations accelerate, value creation is increasingly shifting away from infrastructure buildout and toward commercial performance. Companies in this space need to take steps to ensure their leadership profile is aligned to today's challenges.

What are the Leadership Skills to Stay Profitable in Midstream?

Three structural shifts are reshaping the midstream commercial model - with impacts for leadership skillsets needed:

Monetising Existing Assets: Greenfield enthusiasm has waned, although opportunities exist in the right markets, particularly in natural gas and LNG, as the sector shifts to support low-carbon fuels. So leaders are expected to monetise what they already own.

Leveraging ESG Expertise: Even without direct renewable exposure, carbon tracking is now embedded in financing, procurement, and regulatory review. So ESG fluency by leaders is no longer optional.

Focusing on Optimisation: Arbitrage, shorter contracts, and export-linked pricing dominate. So margins are linked to leadership experience in timing, optionality, and optimisation, not just volume.

Experience alone is insufficient; executives must be adaptable, financially fluent, and operationally agile

How is the Executive Profile Evolving?

Boards and investors now expect commercial fluency, transformation readiness, and capital market savvy - not just tenure. Here's how investor expectations are reshaping the C-suite:

- CEOs must narrate investor strategies and reposition the business.

- CCOs Chief Commercial Officers are judged by system value creation, not just relationships.

- COOs enable cost, emissions, and digital efficiency.

- CFOs especially in PE-backed firms, now come from banking/PE—focused on deal execution, capital structure, and exits.

Conclusion

Top midstream firms aren’t just hiring differently: they’re building a new commercial architecture, with leadership strategies to match today's business context.

HC Group is a global search firm dedicated to the energy and commodities markets.

Learn more about our Liquid Fuels Talent Practice

Contact Alex Coghlan to learn more about the trends behind this whitepaper

Explore more HC Group Talent Insights