Each month, HC Group's Talent Intelligence team brings you an expert view of the human capital landscape in commodity trading. Drawing on HC Group's unique position as global search specialists in the energy and commodities markets, we will decode the trends shaping talent strategies across the industry.

In this month’s edition, we examine the shifting landscape of business development and origination talent across commodity markets. Our analysis reveals that while traditional trading hubs face talent contraction, emerging markets are creating new opportunities for skilled originators.

Subscribe to our newsletter and stay ahead of the curve.

What are the Emerging Talent Hubs?

The traditional powerhouses of Houston, London, and Singapore remain the primary concentrations of origination talent, yet all three hubs are experiencing notable contractions:

- Houston: -3.2% year-on-year

- London: -2.1%

- Singapore: -6.3%

By contrast, emerging markets are expanding. Mumbai has seen a 7.7% increase, fuelled by India’s evolving energy and industrial policies, growing demand across metals and fuels, and a national push toward energy security and resource diversification.

As mature markets consolidate, firms are actively investing in untapped geographies, where origination requires local partnerships, project structuring, and a deep understanding of domestic market dynamics. These trends apply not only to traditional energy but also to ferrous metals, critical minerals, and agriculture, where domestic supply chains and regional relationships are increasingly critical.

Order Our Global Energy Trading Compensation Report 2025

- 200+ Trading Positions Analysed

- Global Coverage Across Key Regions

- Complete Energy Markets Coverage

- Latest Market Intelligence

For more information contact: intelligence@hcgroup.global

Is the Origination Talent Squeeze Disrupting the Pipeline?

Whilst it may appear that talent is in abundance, firms are facing a far more nuanced origination talent challenge: not an oversupply, but a growing imbalance.

- Senior exits are accelerating, particularly in legacy hubs. These professionals bring decades of commercial experience in energy, metals, and bulk logistics, and their departure creates significant gaps that are difficult to fill.

- Mid-level originators (7–15 years of experience) are thinning out. Many are moving into adjacent roles such as structured trading, project finance, or carbon and sustainability strategy, as firms blur the lines between traditional deal origination and broader commercial mandates.

- Junior pipelines remain weak. Origination is rarely a first career step, and few organisations offer structured training pathways into these roles. This leaves many firms vulnerable to succession gaps, particularly in traditional hydrocarbons and metals markets, where the deal landscape is rapidly evolving.

Is Adaptation the Key to Success?

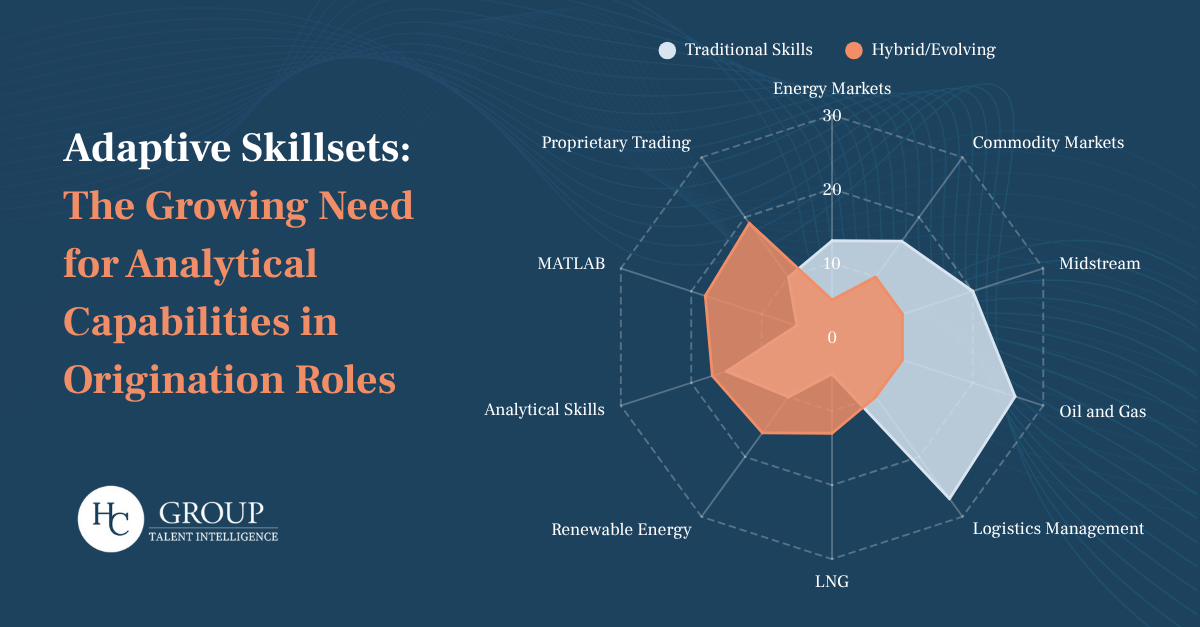

As origination becomes more hybrid and strategic, the skill profile of the originator is also changing.

While traditional market knowledge (e.g. “oil and gas” or “metals trading”) remains foundational and cited by over 25% of professionals, it is no longer sufficient on its own. Today’s originators must pair that knowledge with an increasingly agile, analytical, and cross-functional toolkit.

- Analytical capability has become a key differentiator. Originators are now expected to model scenarios, structure complex transactions, and navigate regulatory or sustainability constraints.

- Renewables and transition-focused knowledge is rising across sectors. “Renewable energy” appears in 16.2% of talent profiles, but similar themes are present in sustainable fuels, circular metals, and climate-aligned agriculture.

Despite this evolution, fluency in commodity markets remains critical. The most effective originators blend deep sector knowledge with adaptability, enabling them to operate across various sectors, including energy, metals, and beyond.

Originators are now expected to model scenarios, structure complex transactions, and navigate regulatory or sustainability constraints.

How Significant Are the Strategic Implications?

These shifts reflect a broader transition: not just in the volume of available talent, but in the nature of origination work itself.

As the mid-level pipeline narrows, and as deal complexity increases across metals, energy, ags, and carbon, firms are expanding the skillsets they hire for and redefining what “good” looks like in commercial roles.

Some are drawing talent from strategy, supply chain, or carbon origination. Others are upskilling internally, recognising that successful originators now operate at the intersection of markets, analytics, partnerships, and policy.

The firms that succeed will be those that treat origination not as a fixed job description, but as a strategic talent platform: adaptive, well-resourced, and aligned with the shifting realities of global commodity trade.

Thank you for reading this analysis from our Talent Intelligence Team.

To get more charts and insights delivered direct to your inbox, why not sign up to HC Group's Talent Intelligence Newsletter.