Metals trading is central to the modern commodities ecosystem: at the heart of a Venn diagram of energy security, economic resilience and the energy transition - as shown in the illustration for this article. So argues Paul Chapman, HC Group's Managing Partner, in the Q2 Market Review - our quarterly deep dive into the latest talent trends reshaping global energy and commodities markets.

In this edition we also explore the talent opportunities of the Battery Energy Storage System (BESS) revolution. We investigate the Operations Talent hubs redrawing the map of commodities recruitment (see our infographic, below). We also include more than 350 notable People Moves - our unique guide to some of the key professionals who moved roles in global commodities Q2 2025.

We hope you enjoy this preview.

Data Story: Commodities Talent Trends

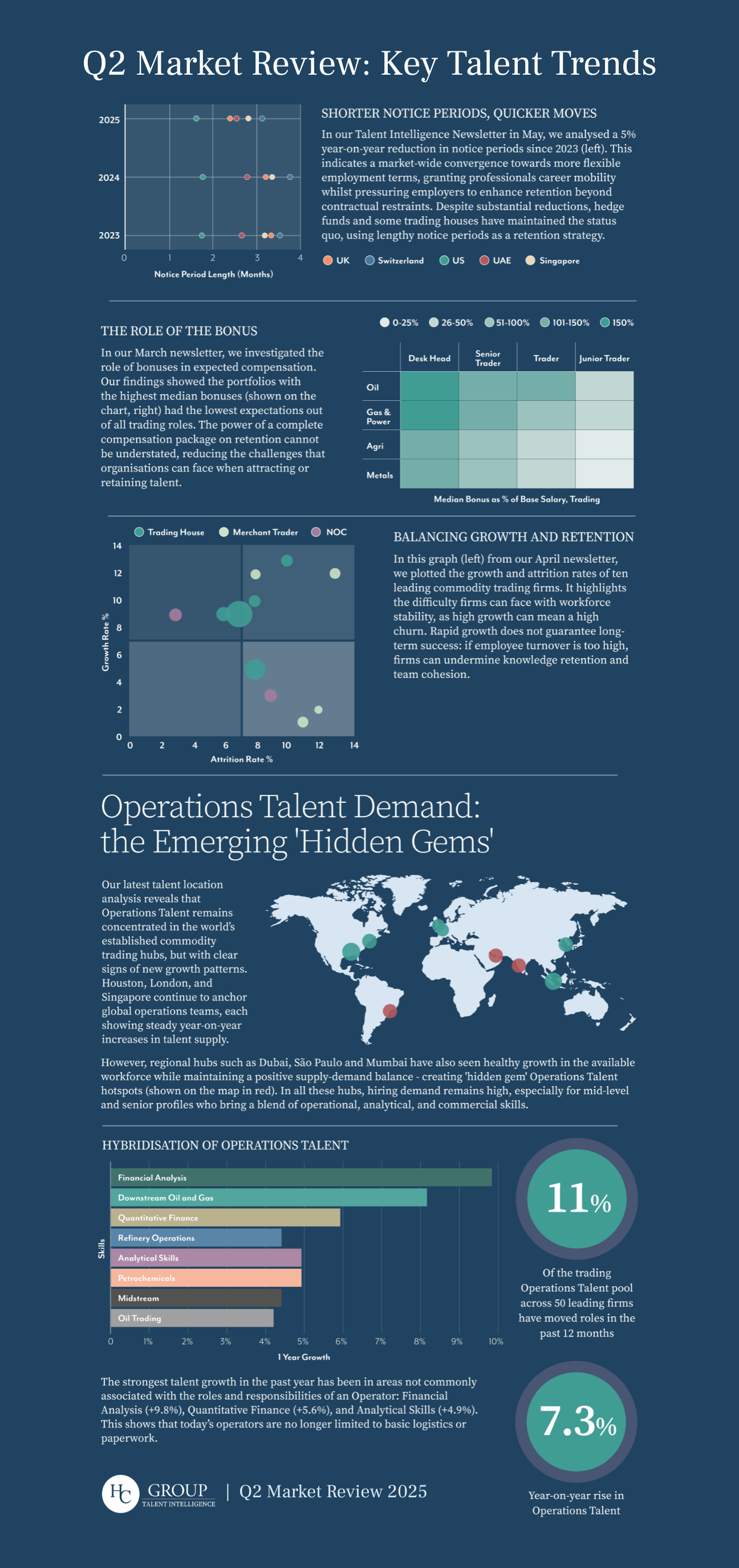

In the Q2 Market Review, our HC Talent Intelligence data team discusses their recent analysis of the 5% year-on-year reduction in notice periods since 2023 - and what lies behind it (see infographic, below). They explore topical commodities talent issues including the evolving role of bonuses and the link between high growth and staff retention challenges. We also take a deep dive into Operations Talent - including a look at why regional hubs like Dubai, São Paulo and Mumbai can be viewed as 'hidden gem' hotspots for essential commodities support services.

Inside the Q2 Market Review

- 350+ People Moves across commodities

- Spotlight on metals trading talent

- Battery Energy Storage System roles in demand

- Talent trends analysis from our global network of consultants

Guest Article Preview: Battery Energy Storage System (BESS) Surge - Impacts for Talent Demand

For the Q2 Market Review, David Beeston, Director of Energy Storage & Grid at Hyperion Search, an HC Group company, reflects on the Battery Energy Storage System (BESS) trends that are reshaping talent demand.

"In Q2, we saw a continual rise in European BESS capacities, especially at Utility-scale. Tariffs and tax subsidy changes have driven uncertainty in the US, leading to difficulties for several battery companies, but opportunities in EMEA. Europe has also seen major market and regulatory reforms announced, aimed at reducing barriers to entry. This shift is mirrored in recruitment.

We’ve seen a sharp uptick in demand for professionals who understand the battery value chain, from grid specialists to market strategists. Asset managers are particularly sought-after, as developers race to bring projects online and harness the opportunities that new market reforms and evolving regulatory frameworks - like the UK’s grid updates - bring.

Energy Storage and Grid: In-Demand Talent

- Strategy / Market Leads: Experts on the evolving ESS revenue markets

- Asset Managers: Those who can help steer storage assets to optimal returns and performance

- Sales (C&I & Grid-scale BESS): Those who can hunt new business and build healthy project pipelines

- Grid Specialists: Experts who can help overcome grid connection barriers and network with system operators."