Each month, HC Group's Talent Intelligence Team brings you an expert view of the human capital landscape in commodity trading. Drawing on HC Group's unique position as global search specialists in energy and commodities markets, we will decode the trends that are shaping talent strategies across the industry.

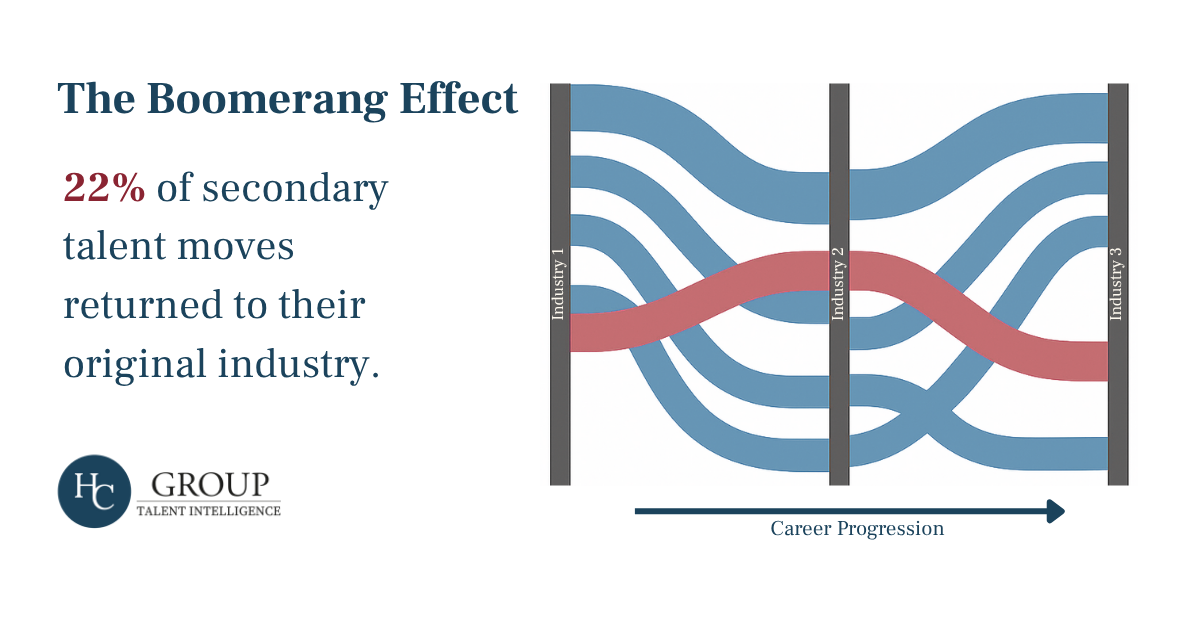

In this edition, we examine recent Talent Intelligence data showing how 22% of secondary career moves by traders involve a return to their original industries - the so-called 'Boomerang Effect'.

1. Decoding the Boomerang

According to our research, 22% of secondary career moves recorded over a 3-year period involve a return to the original industry. These are not simply lateral moves or retreats: they often represent deliberate recalibration after a foray into an adjacent or emerging sector.

Interestingly, whilst the majority are seeking the familiarity, rhythm, and strategic clarity of a similar environment, they once left behind and not the exact four walls they once worked within, 4% of those returning have been recorded as rejoining their former employer.

Order Our Global Energy Trading Compensation Report 2025

- 200+ Trading Positions Analysed

- Global Coverage Across Key Regions

- Complete Energy Markets Coverage

- Latest Market Intelligence

For more information contact: intelligence@hcgroup.global

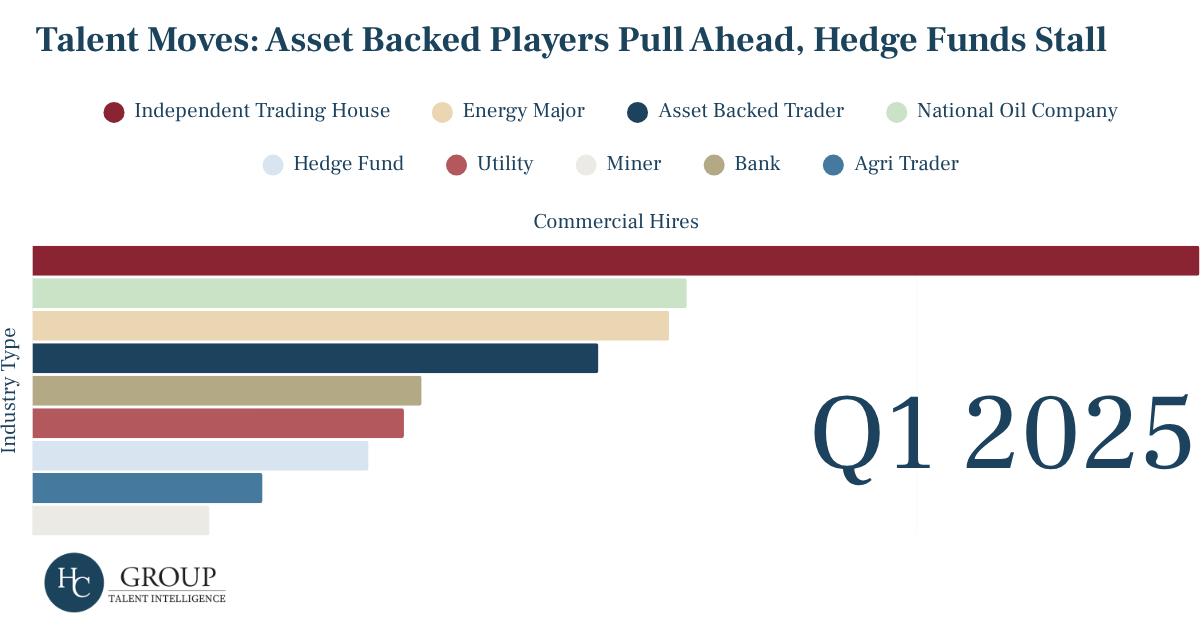

2. Asset-Backed Appeal

From Geneva to Houston, Singapore to London, we see this trend playing out across trading houses, hedge funds, and asset-backed players. Professionals may leave for a role in an adjacent space, but many circle back within 18–30 months, returning with greater perspective, a broader skillset, and a clearer sense of how they create value within the trading ecosystem.

The proverbial tail between one's legs that was once attached to returning is fading, replaced by a more pragmatic view that values prior knowledge, cultural alignment, and proven capability.

Rehires, particularly those who have gained external experience, are often seen as lower-risk, higher-impact additions to teams. This is particularly the case amongst companies with an asset footprint, where we've seen an uptick of talent flow from leaner, proprietary trading environments such as hedge funds since the start of 2025.

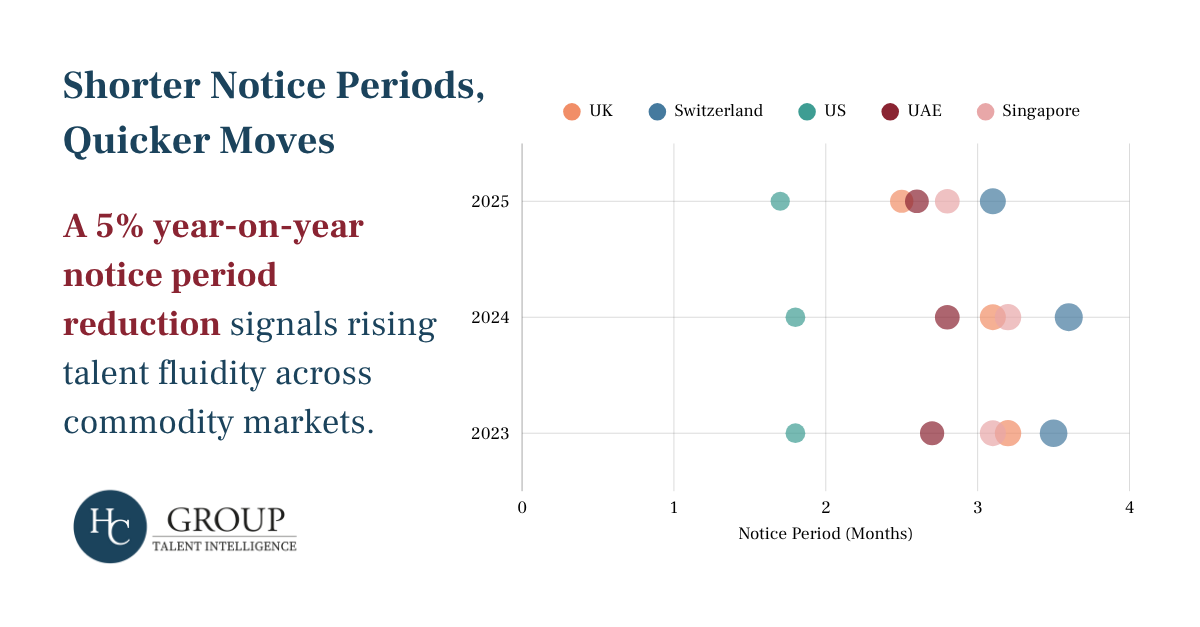

3. Moving Faster

The broader workforce landscape is also enabling this shift. Notice periods have declined by 5% globally over the past year, allowing for quicker transitions and reducing barriers for return moves. This is especially evident in markets like the US, where contractual flexibility is higher.

The convergence towards more flexible employment terms suggests increasing competition for talent and adaptation to faster business cycles, a significant shift that grants professionals greater career mobility whilst pressuring employers to enhance retention strategies beyond contractual constraints. Despite these substantial reductions, certain sectors maintain relatively lengthy restrictions, including hedge funds and some trading houses.

For employers, the implications are clear: talent mobility is no longer linear; exit does not always mean loss. The organisations that succeed in the current cycle will be those that maintain strong networks, move quickly when return opportunities arise, and create structures that allow returning talent to plug in at speed and scale.

Thank you for reading this analysis from our Talent Intelligence Team.

To get more charts and insights delivered direct to your inbox, why not sign up to HC Group's Talent Intelligence Newsletter.