Each month, HC Group's Talent Intelligence Team brings you an expert view of the human capital landscape in commodity trading. Drawing on HC Group's unique position as global search specialists in energy and commodities markets, we will decode the trends that are shaping talent strategies across the industry.

In this edition: a 7.3% year-on-year rise in Operations Talent highlights how this function is evolving from traditional logistics support to a strategic pillar within the trading lifecycle.

1. What are the Operations Talent Hotspots?

While traders negotiate and close deals, it’s the operators who make them happen, managing the end-to-end process, from scheduling and logistics to risk controls and settlements. Without them, trades don’t flow, risks aren’t contained, and margins can slip away unnoticed.

Using LinkedIn Talent Insights and our own data, we have found that the overall Operations Talent pool has increased by 7.3% across 50 of the leading commodity trading companies and that more than 11% of Operators within these firms have moved role in the last 12 months.

Our latest location analysis confirms that Operations Talent remains heavily concentrated in the world’s established commodity trading hubs, but with clear signs of new growth patterns. Houston, London, and Singapore continue to anchor global Operations teams, each showing steady year-on-year increases in talent supply.

Without Operators, trades don’t flow, risks aren’t contained, and margins can slip away unnoticed

Order Our Global Energy Trading Compensation Report 2025

- 200+ Trading Positions Analysed

- Global Coverage Across Key Regions

- Complete Energy Markets Coverage

- Latest Market Intelligence

For more information contact: intelligence@hcgroup.global

Houston recorded the highest growth among mature hubs, with an 8% increase in Operations professionals. London and Singapore also saw modest but consistent growth, up 3% and 4% respectively, despite strong competition for experienced hires. In all three hubs, hiring demand remains very high, especially for mid-level and senior profiles who bring a blend of operational, analytical, and commercial skills.

Large regional hubs such as Dubai, São Paulo and Mumbai have seen healthy growth in the available workforce but still maintain a positive supply-demand balance, creating 'hidden gem' talent hotspots, shown on the map in red.

These locations combine strong sector knowledge with lower costs and an increasingly sophisticated talent base. For many trading firms, they present a real opportunity to scale trading support functions, build follow-the-sun coverage models, and manage complex portfolios closer to regional flows.

2. The Hybridisation of Operations Talent

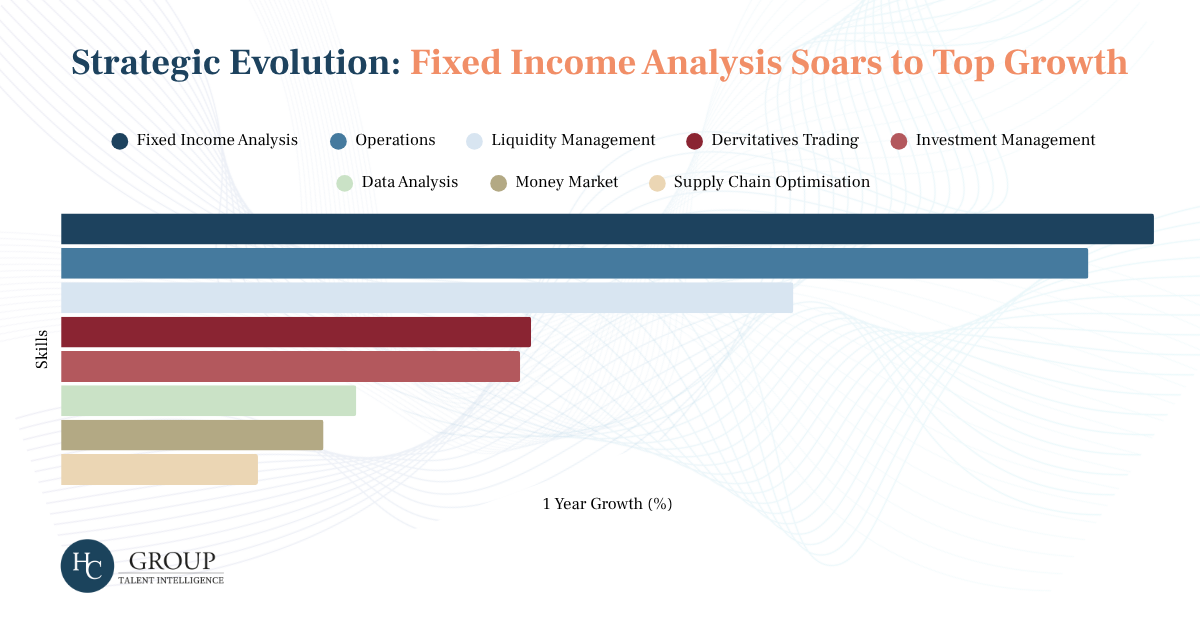

The strongest growth areas of growth in the past year have been in areas not commonly associated with the roles and responsibilities of an operator: Financial Analysis (+9.8%), Quantitative Finance (+5.6%), and Analytical Skills (+4.9%). This shows that today’s operators are no longer limited to basic logistics or paperwork. They’re increasingly financially literate, able to analyse margins and exposures, and comfortable working with data to optimise flows. At the same time, robust growth in sector-specific knowledge like Downstream Oil & Gas, Petrochemicals, and Midstream underscores how operators now need deep supply chain and asset understanding to navigate complex deal structures.

Taken together, this shows Operations Talent professionals are becoming true hybrid talent: bridging back-office execution, middle-office risk oversight, and front-office commercial awareness. This rounded skillset is exactly what’s making Operations a springboard into more senior commercial and analytical roles.

3. Operations Careers: Not One-Size-Fits-All

What’s often overlooked is that Operations is not just a stepping stone, it’s a high-value career path in its own right, with clear vertical progression into senior leadership roles like Head of Trading Operations or regional operations lead. Operators build deep expertise in managing complex physical flows, contract structures, and regulatory environments — making them indispensable to the strategic success of the trading desk.

At the same time, the unique skills an Operator develops (like market knowledge, systems proficiency, commercial acumen, and analytical rigour) make them well positioned for lateral moves into areas like risk management, scheduling, market analytics, or front-office trading. Many firms now actively encourage this mobility, with employers such as BP including rotations in operations as part of their Trader Development Programmes - recognising that operators often have a valuable practical understanding of the deal lifecycle and supply chain dynamics.

From Geneva to Houston, Singapore to London, Operations is evolving into a critical trading support function that sits at the intersection of execution, risk oversight, and margin protection. For employers, that means investing in Operations doesn’t just protect today’s flows, it develops tomorrow’s traders, risk analysts, and supply chain leaders too.

Thank you for reading this analysis from our Talent Intelligence Team.

To get more charts and insights delivered direct to your inbox, why not sign up to HC Group's Talent Intelligence Newsletter.