Each month, HC Group's Talent Intelligence Team brings you an expert view of the human capital landscape in commodity trading. Drawing on HC Group's unique position as global search specialists in energy and commodities markets, we will decode the trends that are shaping talent strategies across the industry.

In this edition, we explore how firms are balancing growth with retention, where talent is flowing between organisations, and which global hubs are driving the most hiring activity.

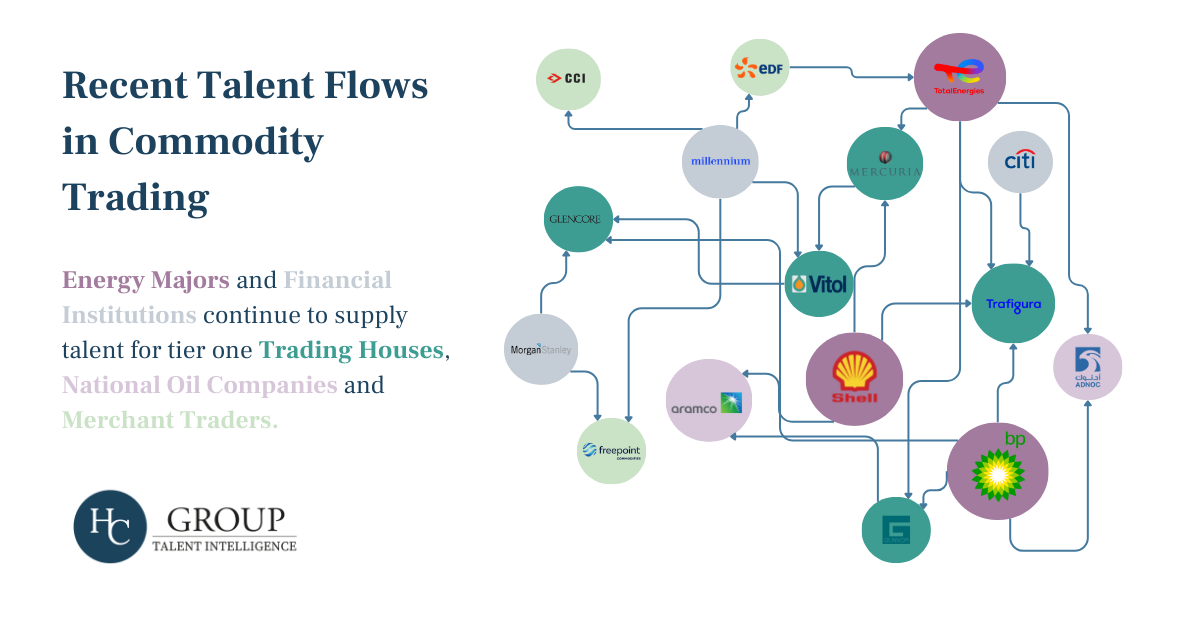

1. Inter-Firm Talent Flows: Understanding Movement Across the Sector

Our talent flow map reveals a tightly interconnected ecosystem. Energy majors such as Shell, BP, and Total serve as the industry’s “university,” consistently feeding talent across the sector. Banks remain key feeder channels, while merchant traders — Vitol, Trafigura, Glencore, Mercuria, and Gunvor — engage in constant cross-hiring, fuelling rising compensation and cultural evolution.

Talent movement now cuts across sectors, regions, and functions. For trading houses, NOCs, and merchants, the challenge is no longer just about attracting external talent — it’s about integrating that talent effectively, aligning it with strategy, and retaining it in an increasingly fluid market. Firms that balance external hiring with internal development, while building a cohesive culture, will be best positioned for long-term advantage.

Order Our Global Energy Trading Compensation Report 2025

- 200+ Trading Positions Analysed

- Global Coverage Across Key Regions

- Complete Energy Markets Coverage

- Latest Market Intelligence

For more information contact: intelligence@hcgroup.global

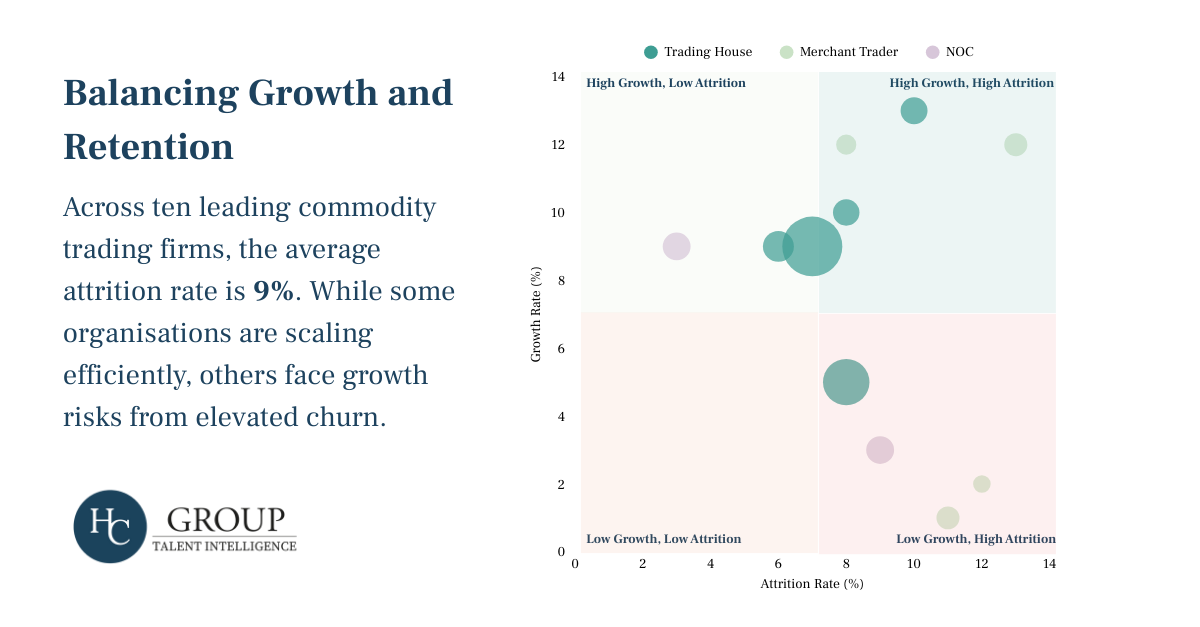

2. Balancing Growth and Retention Across Trading Firms

Chart 2 plots growth and attrition rates across ten leading commodity trading firms, highlighting which organisations are scaling efficiently and which face risks from elevated churn. While the industry average attrition rate stands at 9%, firm-level differences reveal sharp contrasts in workforce stability.

The data underscores a key point: rapid growth does not guarantee long-term success. Firms in the high-growth, low-attrition quadrant are best placed to build resilient organisations, while those expanding amid high churn risk undermining knowledge retention and cohesion. Balancing expansion with retention is emerging as a critical differentiator in today’s competitive market.

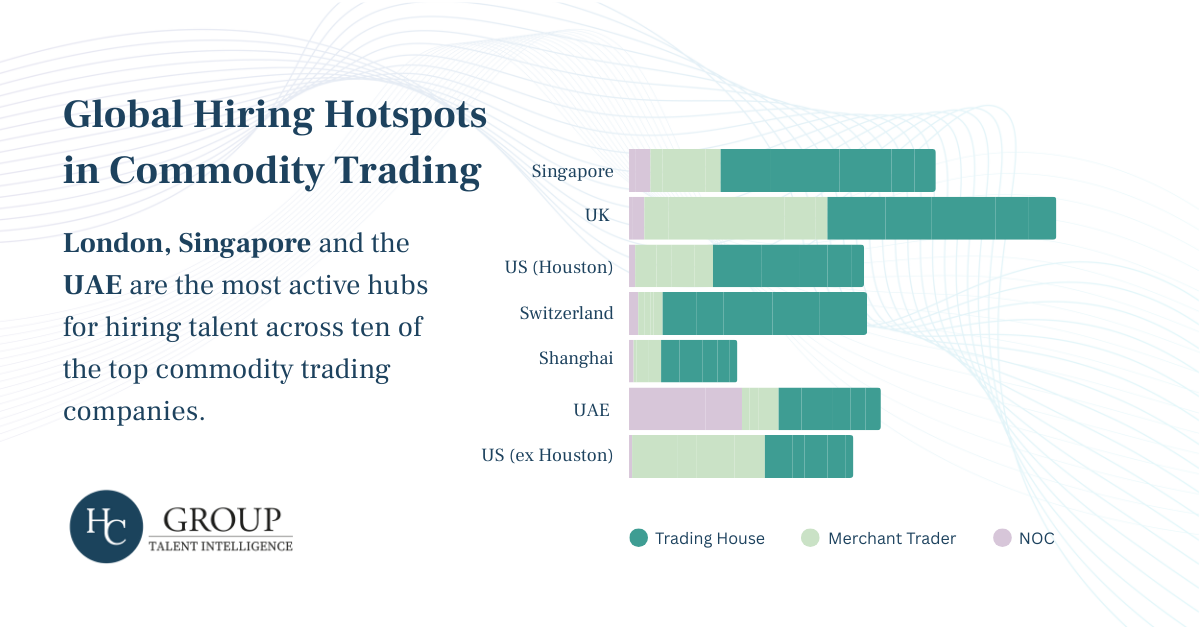

3. Global Hiring Hotspots in Commodity Trading

This chart highlights the geographic concentration of hiring activity across ten leading commodity trading firms. London, Singapore, and the UAE have emerged as the most active global hubs, reflecting their strategic importance in the sector.

- London continues to lead, particularly for financial, risk, and commercial roles.

- Singapore has strengthened its position as the leading hub for Asia-Pacific, attracting talent across front- and middle-office functions.

- The UAE is rapidly gaining prominence, reflecting the growing influence of national oil companies and their international trading arms.

- Switzerland — long regarded as a core hub for commodity trading — no longer ranks among the top three global hiring centres. While it remains important, particularly for European merchant traders, its hiring volume has been surpassed by London, Singapore, and the UAE, reflecting the growing pull of both financial and emerging energy hubs.

The global distribution of hiring points to an industry increasingly concentrated in a few talent-dense cities — intensifying competition and raising the stakes for talent strategy and location planning. As the competition for talent intensifies, the firms that thrive will be those that don’t just react to market trends, but anticipate them — balancing smart hiring with strong retention, and leveraging both established and emerging hubs.

Thank you for reading this analysis from our Talent Intelligence Team.

To get more charts and insights delivered direct to your inbox, why not sign up to HC Group's Talent Intelligence Newsletter.