Each month, HC Group's Talent Intelligence team brings you an expert view of the human capital landscape in commodity trading. Drawing on HC Group's unique position as global search specialists in the energy and commodities markets, we will decode the trends shaping talent strategies across the industry.

After a hiatus over the summer, we examine the post-COVID hiring patterns that are quietly rewiring global commodities trading. We analysed recent hiring trends across four leading trading organisations in London, Geneva, Singapore, Houston, Stamford, Calgary and Chicago. The new pipeline is still anchored on elite STEM schools, but it’s broadening fast.

Subscribe to our Talent Intelligence Briefing email to stay ahead of the curve.

The Floor is Too Quiet

Five years after COVID sent junior traders and analysts to work from their kitchen tables, the effects are showing. Leaders across trading, risk, and operations are flagging a concerning pattern:

- Weaker cross-desk collaboration

- Slower commercial reflexes

- More siloed problem-solving

In this environment, where success depends on speed and informal information flow, the loss of ‘floor culture’ is becoming a strategic problem. If firms don’t act now, they may face a “hollow middle” in 3–5 years' time where too few traders are ready to take over senior seats.

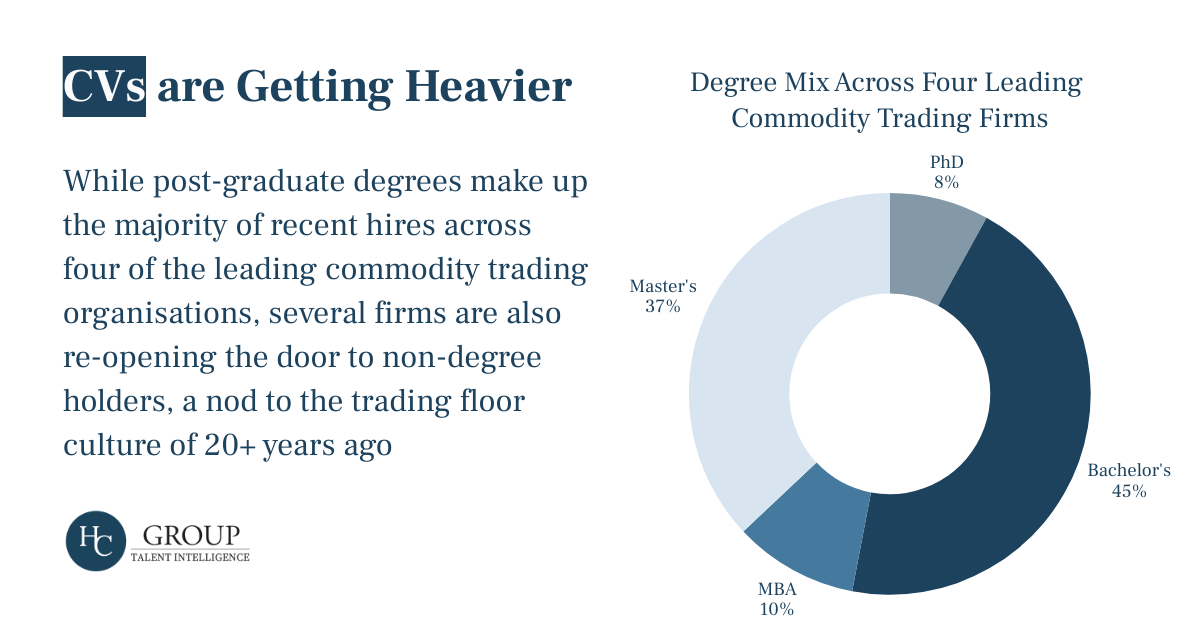

The CV is Getting Heavier, But Not for Everyone

Our analysis across four major trading firms shows a clear shift: Master’s degree hires are rising sharply, MBA intake remains steady, and PhDs are becoming more visible, particularly in research and quant roles.

This indicates that firms are prioritising ready-to-contribute capability. Rather than relying solely on apprenticeship-style development on the trading floor, they are deliberately hiring talent that can step into complex roles with less ramp-up time.

But there is an interesting counter-trend emerging: some trading houses are also starting to re-hire street-smart, commercially savvy profiles they would have sought out 20+ years ago: sharp commercial operators without formal degrees but with strong market instincts, hustle, and risk appetite.

This two-tier approach suggests firms are re-balancing their pipelines:

- Graduate-heavy intake to meet technical, quantitative, and regulatory demands

- Pragmatic, non-degree hires to inject energy, creativity, and commercial edge back into the floor

Order Our Global Energy Trading Compensation Report 2025

- 200+ Trading Positions Analysed

- Global Coverage Across Key Regions

- Complete Energy Markets Coverage

- Latest Market Intelligence

For more information contact: intelligence@hcgroup.global

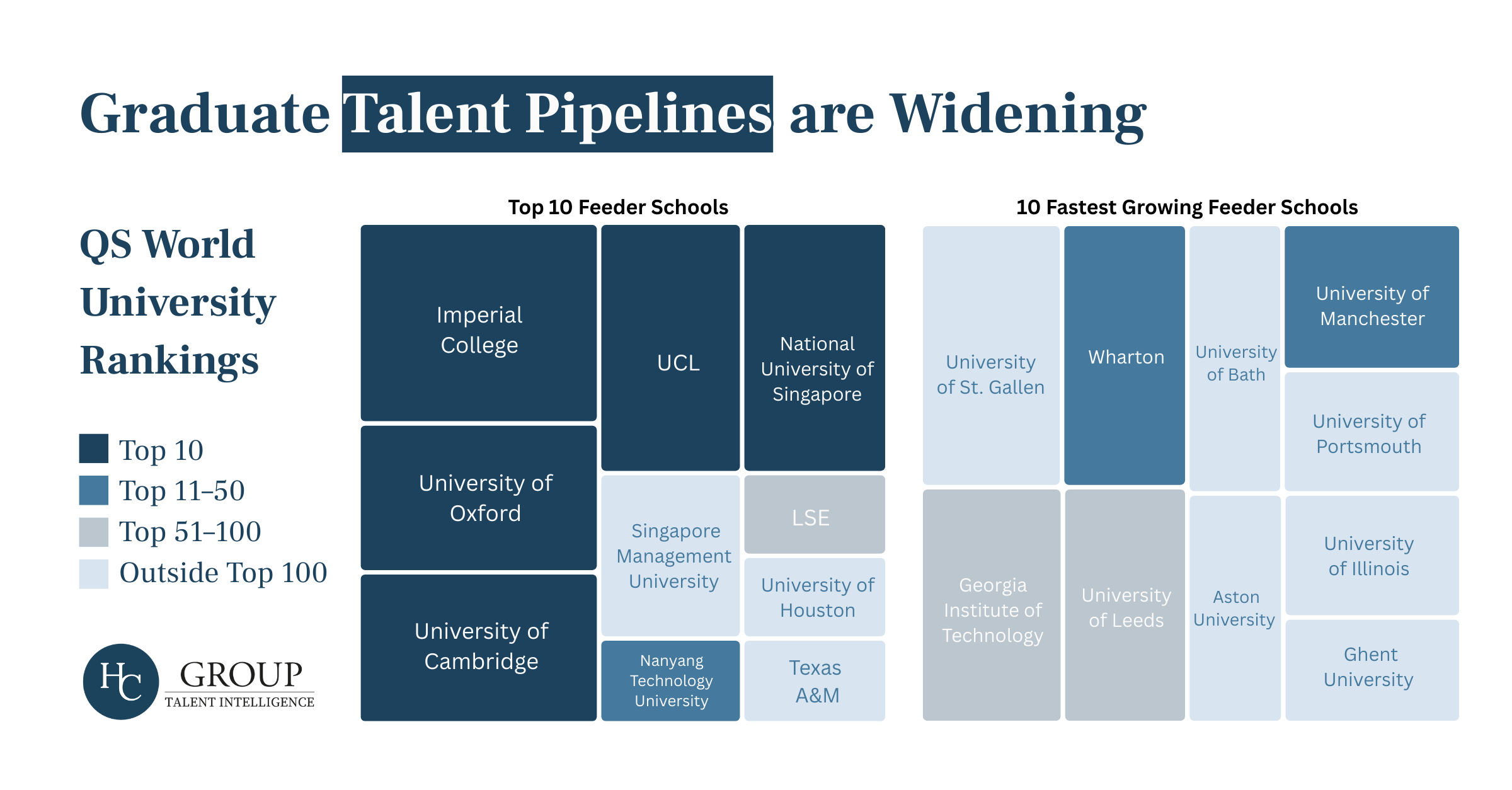

Graduate Talent Pipelines are Widening

In exploring where firms are sourcing their graduate-level talent, two patterns stand out. First, a consistent core of elite institutions: Imperial College, Oxford, Cambridge, UCL, and NUS continue to dominate the feeder school landscape, appearing in nearly every firm’s top 10. These are not just familiar names: all are firmly within the Top-10 QS global rankings, reinforcing that prestige remains central to pipeline strategy.

But secondly, the fastest-growing schools tell a slightly different story. Institutions like Georgia Tech and Leeds University are increasing their share of hires rapidly. While many of these are in the Top-100 global tier, very few are breaking into the top echelon (Top-10 or Top-50). This suggests that firms are diversifying their feeder sources, expanding beyond traditional prestige, but without compromising quality. They’re drawing from schools and universities that offer technical strength or regional influence, often in the US and Europe, while still keeping the global leader board in view.

Together, these trends reflect a balanced strategy: maintain the core anchors of talent while widening the reach to under-leveraged, rising institutions. The story here is about growing scale without diluting brand, sourcing new skill sets and geographies while protecting the quality signal.

The future of trading talent is not just about elite degrees

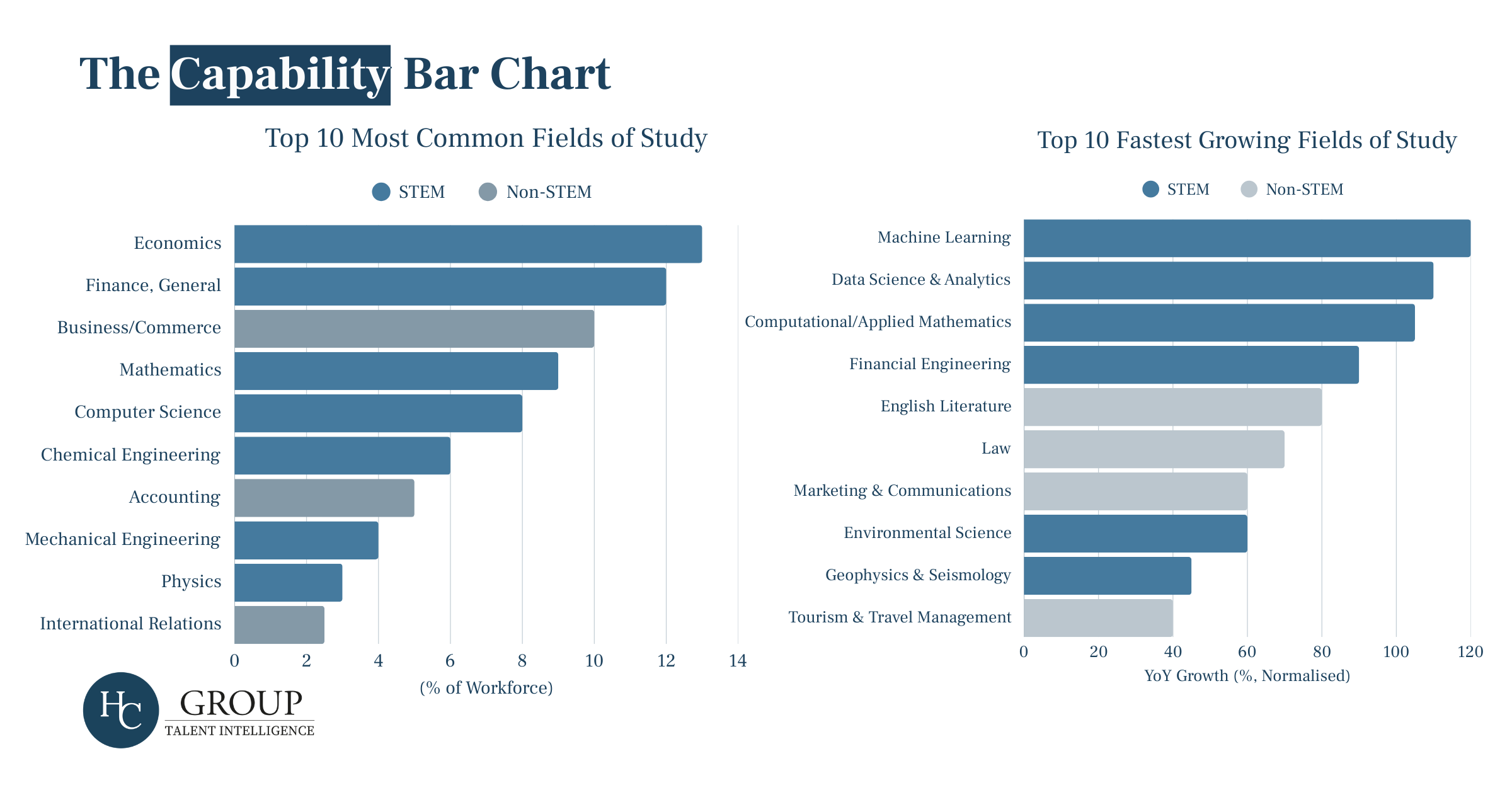

Fields of Study Aren’t What They Used to Be

Across the trading and hedge fund landscape, the skills profile of new hires is polarising. Firms are building what we call a capability bar chart, loading up on two very different but complementary types of talent.

On one end, there is a clear push into deep technical expertise, with machine learning, data science, applied mathematics, and financial engineering among the fastest-growing fields of study. These hires are critical for powering advanced analytics, risk modelling, and systematic trading strategies.

On the other end, we see growth in human and commercial capabilities: law, marketing and communications and even English literature. These skills are increasingly valued for their ability to translate insight into action: originating deals, aligning stakeholders, and rebuilding the collaborative floor culture that was disrupted during COVID.

Closing Insight: Breadth Is Strength

The future of trading talent is not just about elite degrees. Top schools remain central admittedly, but the fastest growth is happening outside the old guard, and some firms are rediscovering value in non-university routes altogether.

By combining academic pedigree, applied technical skill, and “on-the-ground” commercial experience, firms are building more resilient teams. This breadth of knowledge, experience, and perspective is essential to tackling a market that demands both algorithmic precision and human judgment.

Thank you for reading this analysis from our Talent Intelligence Team.

To get more charts and insights delivered direct to your inbox, why not sign up to HC Group's Talent Intelligence Newsletter.