Each month, HC Group's Talent Intelligence team brings you an expert view of the human capital landscape in commodity trading. Drawing on HC Group's unique position as global search specialists in the energy and commodities markets, we will decode the trends shaping talent strategies across the industry.

Singapore and the UAE (and the broader GCC) may be roughly 6,000 kilometres apart, but their stories in 2025 share a common theme: support functions have stepped out of the background and onto the trading floor. Yet the way each market is building, rewarding, and retaining talent says as much about their histories as it does about their ambitions.

Subscribe to our Talent Intelligence Briefing email to stay ahead of the curve.

Support Function Salaries Are Rising, But for Different Reasons

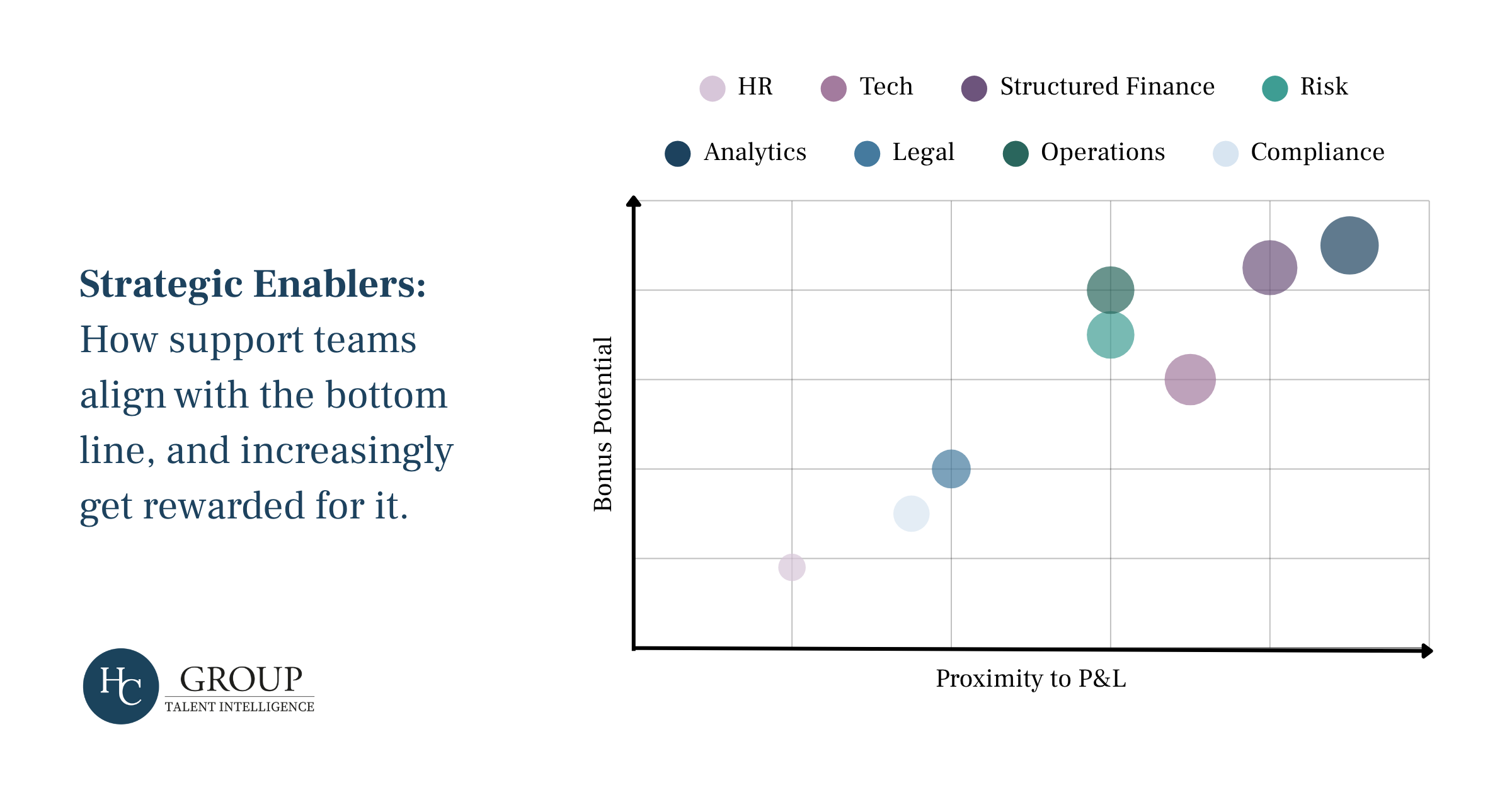

Pay is rising in both markets, but for nuanced reasons. In Singapore, salary growth has been defensive. Post-pandemic rental and schooling costs have surged by 40–80%, and firms have been forced to build retention into fixed pay. Six to seven per cent annual cost-of-living adjustments are now commonplace among corporates; however, this is often not enough. Bonuses remain the differentiator: risk and structured finance professionals earn up to 100% of their base salary, while functions sitting further away from P&L sit further behind.

In the GCC, the logic is different. Pay growth is strategic, designed to build, not just retain. With nearly 60% of 2025 hires arriving from outside the region, employers are paying premiums to import maturity and accelerate institutionalisation. Risk Managers in Dubai, for example, now command base salaries of USD 140,000–170,000, with senior leads reaching north of USD 225,000. Analysts at the entry level have also moved up, with starting salaries of around USD 85,000–100,000, a significant jump from pre-2022.

While Singapore pays to keep what it has, the Gulf pays to bring in what it needs. Different pressures, same outcome: both hubs are converging toward competitive benchmarks in total reward.

Order Our Global Energy Trading Compensation Report 2025

- 200+ Trading Positions Analysed

- Global Coverage Across Key Regions

- Complete Energy Markets Coverage

- Latest Market Intelligence

For more information contact: intelligence@hcgroup.global

Mobility and Mindset: Importing Capability, Exporting Experience

If compensation trends show where the pressure is, mobility shows where the momentum lies.

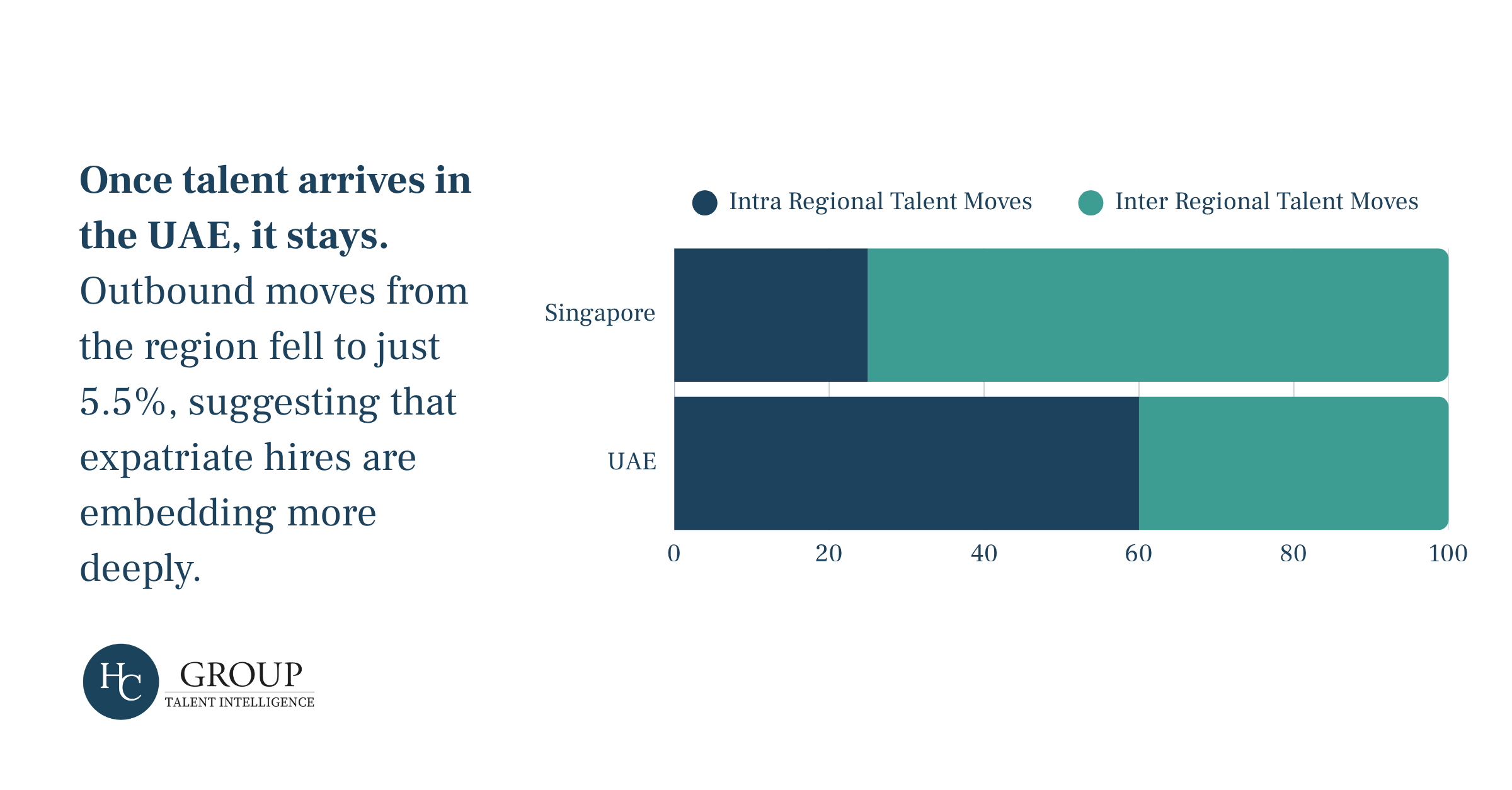

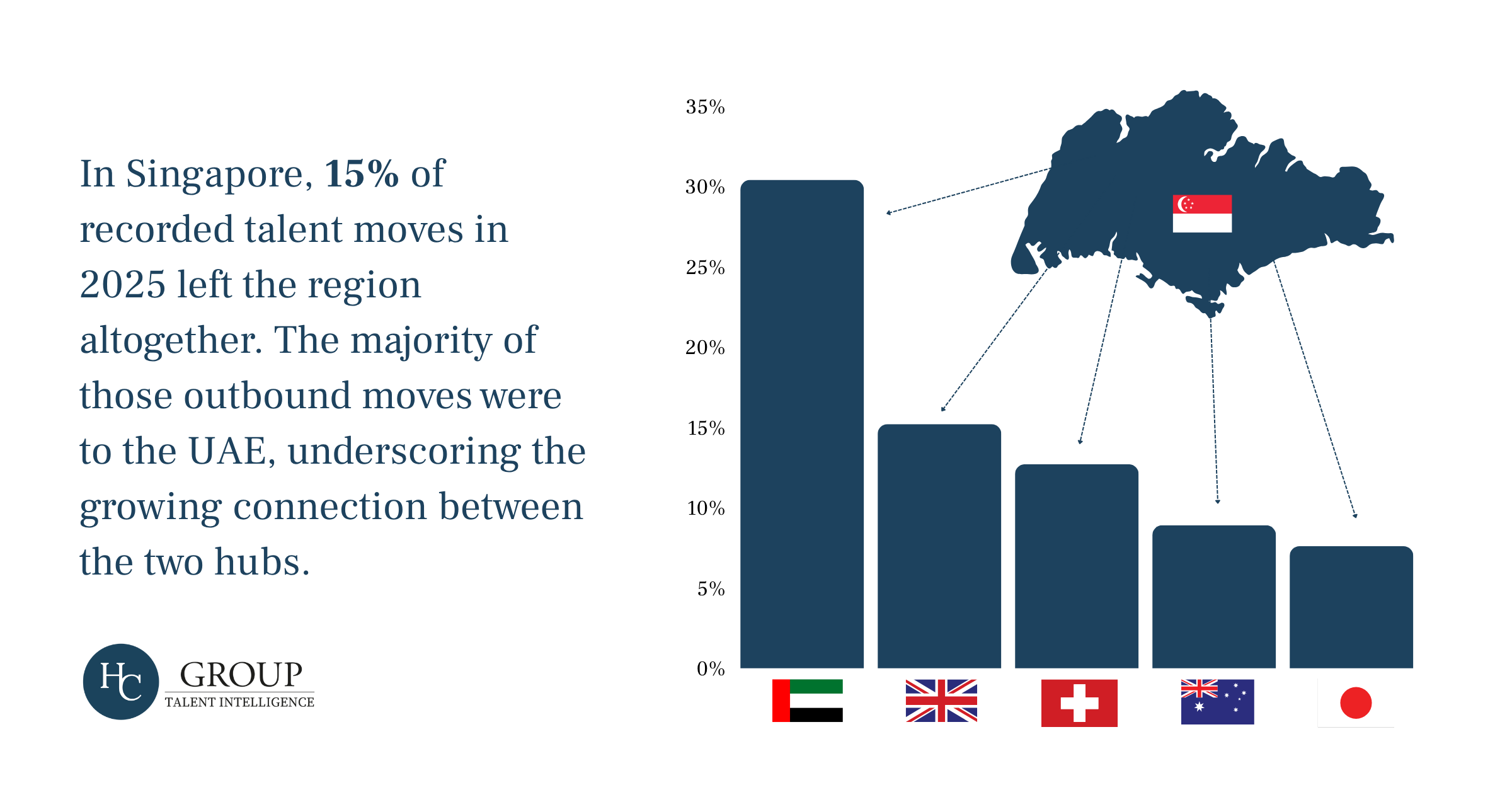

In Singapore, roughly three-quarters of tracked commodity trading hires in 2025 came from within the city-state, but 15% of talent left Singapore altogether. Of those outbound moves:

- 30% went to the UAE

- 15% to the UK

- 13% to Switzerland

- 9% to Australia

- 8% to Japan

The rest were scattered across Europe and North America, a reminder that Singapore remains deeply tied to global capital flows. The city continues to attract mid-level talent from Malaysia and India, replenishing depth even as senior expertise migrates abroad.

Across the water, the pattern reverses. Outbound moves dropped to just 5.5%, suggesting the Gulf’s expatriate workforce is embedded for the longer term. The region remains a net importer of senior capability, risk heads from London, CFOs from Geneva, technologists from Singapore, while Emiratisation builds early-career pipelines beneath them.

Singapore and the UAE share a common theme: support functions have stepped out of the background and onto the trading floor.

Beyond the Hubs: The New Geography of Support Talent

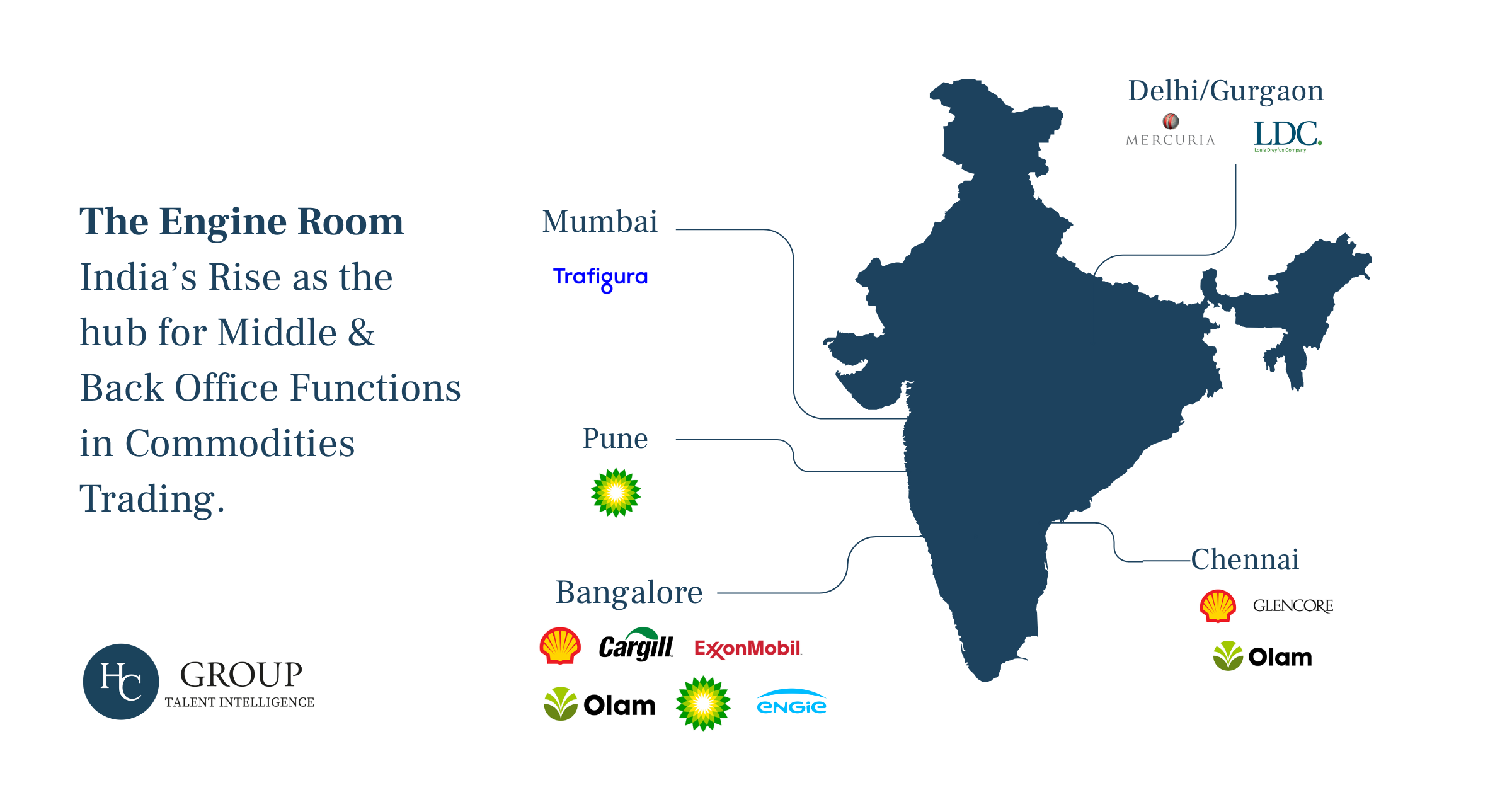

Offshoring in commodities has matured into something far more deliberate, a strategy for scalability and continuity, not just a cost lever. In 2025, the real build-out is happening across APAC, where India has firmly become the backbone of global support for trading and industrial groups.

Singapore and Dubai still anchor the commercial core, but the operational muscle increasingly sits further east. India has emerged as the region’s engine room for shared services, providing both scale and depth of skill across finance, technology, trade execution, and analytics for the world's leading trading houses.

Explore the Data Behind the Story

HC Group’s Middle & Back Office Compensation Report provides the granular insight behind this analysis, from base salary ranges by function and level, to bonus trends, hiring flows, localisation trends, and global benchmarks across all major trading hubs.

Be among the first to access the data behind this story. Register your interest to secure an early-bird discount and advance access to the report when it launches.

Thank you for reading this analysis from our Talent Intelligence Team.

To get more charts and insights delivered direct to your inbox, why not sign up to HC Group's Talent Intelligence Newsletter.