Industrial participants in the natural resource and commodity markets are stepping up efforts to set up and develop their supply and trading capabilities. Considering the specific challenges facing industrials, this article co-written with Energex Partners gives a glimpse of the pitfalls to avoid when sophisticating supply and trading capabilities with regards to organizational and operational structure, risk assessment and talent strategy.

Recent market developments and volatility only emphasize a need for organizations to be smarter about how they optimize their own assets and systems and reach their customers in new and growing markets more effectively. The Russia-Ukraine conflict has had a profound impact on the fundamental outlook of all major commodity groups. The energy transition also highlights the need for more agile sourcing, risk management, optimization of physical flows, pricing and supply capability. This offers opportunities for some, but significant stress for many.

There has been a noticeable trend among the Middle East national oil companies (NOCs) where organizations such as Saudi Aramco, Abu Dhabi National Oil Company (ADNOC), Qatar Energy, and others like Petronas in Asia have been heavily investing to incorporate meaningful trading activity. Companies in the mining and minerals sector, notably Anglo-American and Rio Tinto are also expanding this activity, as are large industrial corporates that are key energy and commodity consumers such as India’s conglomerate Reliance or Spain’s CEPSA.

Different cultures

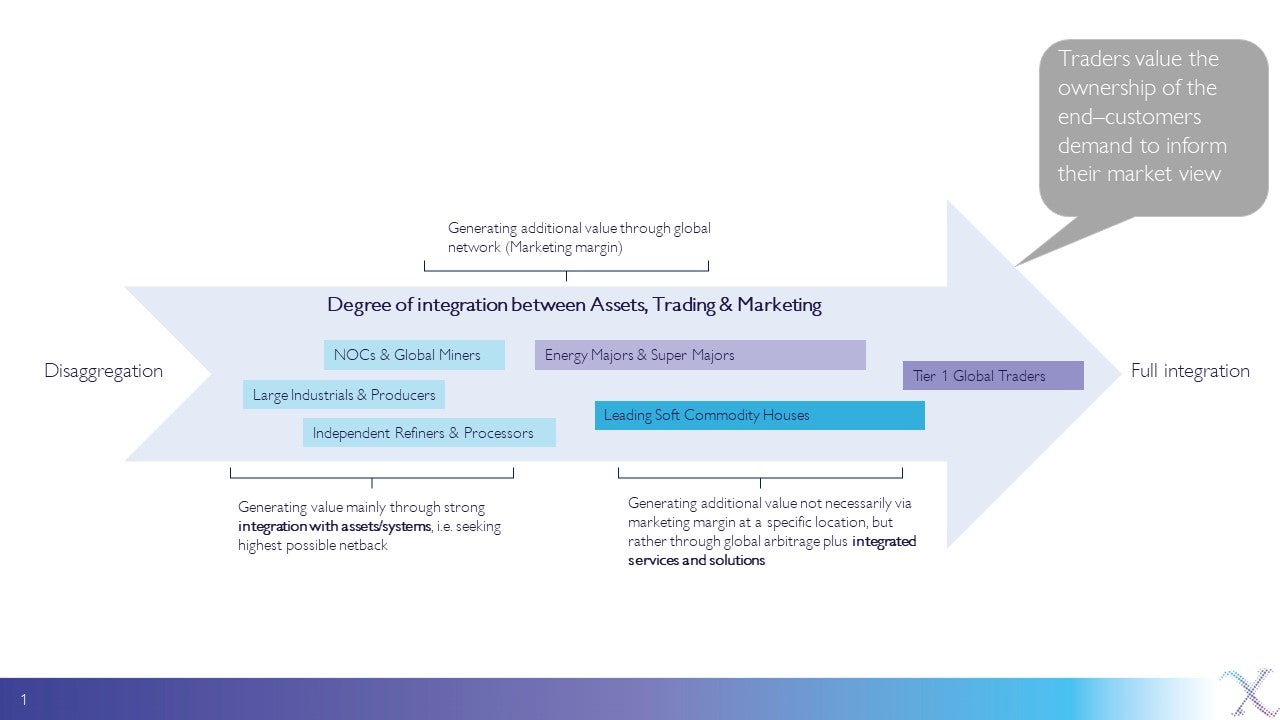

The trading business encompasses a broad range of activities and functions. Unlike the trading houses where the deployment of risk capital is a primary driver, trading in an industrial organization places less emphasis on speculative risk-taking and more importance on the optimization of internal assets and physical flows combined with efficient sourcing and market-based supply and marketing activities. Even between very established oil majors, NOCs and trading houses in the energy sector, there is a difference in sophistication when it comes to their trading activities and degree of value-chain integration and optimization, as illustrated in the diagram below.

The degree of risk-taking and sophistication in more advanced trading organizations is unlikely to be as relevant to many industrial companies and NOCs. Even if resource constraints may not be a barrier for industrials and NOCs, their organizational culture regarding risk-taking for instance and delegation of authority may still be an obstacle (see Don't Dos below).

Don’t Dos

|

Building blocks

Firstly, it is imperative that the organization has a clear set of commercial objectives and a strategic rationale with full buy-in from all key internal stakeholders. This stakeholder agreement should also cover the specific scope of the new and evolved commercial activities. To base the new strategy on only ‘best practice’ or replicating an effort done by a similar organization is not an appropriate approach. Subsequently, there is a need to develop a Target Operating Model (TOM) and associated organization model that enables the successful execution of the tailored strategy. One of the largest cultural challenges for many industrial companies is the absence of an agile decision-making process with clear delegation of authority throughout the trading organization. Many industrial companies traditionally expect significant ‘risk’ decisions to run a longwinded internal process which will result in missed opportunities and frustration, both internally and with customers.

Conversely, to provide confidence to board members, there must be a clear understanding of all the drivers of risk through these new activities with an appropriate implementation of risk limits (see To Dos below). This goes beyond market risk and extends to counterparty risk, liquidity and funding risk, regulatory risk, environmental and franchise risk, etc. Processes must be in place to identify, capture and report to key stakeholders all the relevant risks. Often a significant investment in Information Technology (IT) systems is required to enable these processes.

To Dos for a Successful TOM

|

Many organizations can be crippled by the liquidity and funding needs from trading activities under extreme price movements as seen recently on traded markets in the wake of Russia’s invasion of Ukraine. The new internal trading organization will need dedicated support from internal functions that can develop the specialist knowledge to understand the specific risks and issues to address. This will include operations and logistics teams, credit control, legal and contracts resource, compliance, and regulatory support (‘Know Your Customer’ work, regional market regulations, etc), and treasury support for liquidity and working capital funding, with sufficient balance sheet allocation to support these activities.

Re-assessing skillsets

With regards to skillsets, there is a need to evaluate which positions can be filled by existing internal resources or alternatively, by external hires and advisors. This also means adopting appropriate remuneration packages to attract and retain talent and departing from the traditional remuneration structures within an industrial group. New hiring schemes must be reflective of the culture and scope of activities within the new TOM, instead of seeking to attract talent at any cost. New schemes must offer a suitable balance between rewards and opportunity, through a combination of location, projects, company culture and remuneration. As observed by HC Group, senior professionals often hold longstanding frustrations around deep-rooted processes and procedures in the established organizations for which they work. Therefore, they place a premium on their ability to build rather than inherit internal capabilities.

The Key Considerations for Candidates:

|

The wave of growth and sophistication of trading has intensified the competition for talent. Similarly, retention mechanisms at existing participants who do not want to lose key talent have become more sophisticated. Reduced appetite for career risk in the current climate means the purpose and value proposition to talent need to be more attractive and clearer than ever before. Too often ‘market gossip’, assumptions and misinformation during hiring processes can be damaging if not properly managed.

Such aspects can be addressed at the outset, or even some way into the development of the new trading unit, by working with advisors with deep practical experience in these matters. They can work alongside the organization to identify the unique overlap between relative competitive advantage, opportunities, and corporate constraints. This will effectively pave the way for the development of a strategy and hands-on assistance in the execution of a practical, phased roadmap and plan that is aligned with the existing organization’s culture and to achieve a successful and lasting outcome.

For more information or an initial consultation, please contact:

Anoush Kefayati, Managing Director at HC Group: akefayati@hcgroup.global

Daniel Cordell, Portfolio Director, Gas, Power, and CapitalMarkets at HC Group: dcordell@hcgroup.global

Steve Jones, Partner at Energex Partners: sjones@energex.portners

Kevin Hazell, Partner at Energex Partners: khozell@energex.partners